Economic and Market Perspective from City National Rochdale

There’s been a lot of attention and press given to the recent market volatility and we understand it can be difficult to cut through the noise. We thought everyone would appreciate an expert opinion on the world economy and how it relates to global markets.

The following is an excerpt from City National Rochdale’s “On the Radar, FAQs On The Markets and Economy.” They have a relatively optimistic outlook for the markets, and very specific areas of focus that have led them to their opinions.

The entire newsletter is quite lengthy, but you can download it here.

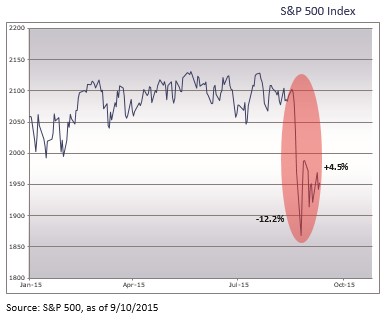

What is causing the market’s recent volatility?

Financial markets recently have been rattled by concerns over slowing growth in China and the spillover effects to the global economy.

As the world’s second largest economy and one of the main sources of global growth, investors have reacted by driving down equity prices irrespective of their connection to China.

The response by Chinese authorities has been weak and inconsistent, raising fears about their ability to manage the slowdown.

Relatedly, the ongoing declines in commodity prices, in part due to weaker emerging market demand, has been seen by many as a potential global recession signal.

With the onset of Fed tightening approaching, investors are also increasingly concerned whether the US economy is strong enough to absorb the anticipated higher rates, especially in light of these global headwinds.

While we acknowledge risks to the outlook, we believe investor reaction has been overdone and is inconsistent with actual underlying economic fundamentals, both at home and abroad. After the sharp initial decline, equity markets for now appear to have stabilized somewhat.

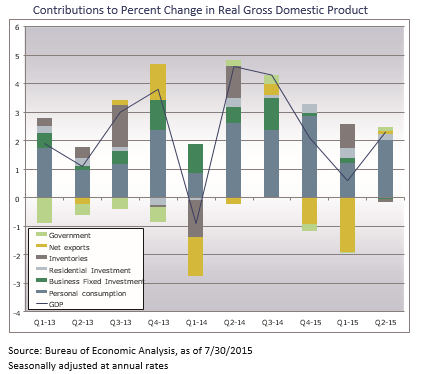

Is the U.S. economy slowing down?

In short, no. The most recent upward revision of Q2 U.S. growth to 3.7% shows the economy regained a substantial amount of momentum after the disappointing start to the year. Most evidence from recent activity and employment data suggests that momentum has continued into Q3 despite headwinds from overseas.

In short, no. The most recent upward revision of Q2 U.S. growth to 3.7% shows the economy regained a substantial amount of momentum after the disappointing start to the year. Most evidence from recent activity and employment data suggests that momentum has continued into Q3 despite headwinds from overseas.

Since mid-May, 74% of cyclical indicators have been positive vs. only 41% in the first four months of this year, and leading indicators are pointing to further improvement ahead.

The upward revision to Q2 GDP was principally because consumption and investment were much stronger than first reported and reveal a domestic economy healthier than previously thought.

Going forward, we expect drag from energy investment and the stronger dollar to continue to weigh on the U.S. economy.

However, low gas prices, rising employment and improving real income gains should enable the U.S. consumer to continue to carry the economy forward, with additional support from the strengthening housing recovery.

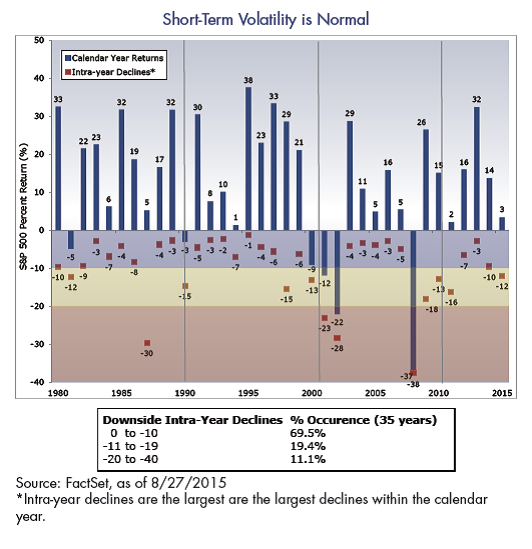

Are recent market declines the beginning of a bear market in Equities?

Concerns over China’s economic slowdown and falling oil prices have roiled financial markets, but in our opinion the declines seen in global equities recently appear out of proportion with economic fundamentals, particularly in the U.S.

There is very little to support fears of a major global downturn.

While China continues to face challenges, its economy is not collapsing and recent data from other major economies, including the U.S., Eurozone and Japan, has generally been good.

While China continues to face challenges, its economy is not collapsing and recent data from other major economies, including the U.S., Eurozone and Japan, has generally been good.

Likewise, an extended period of lower commodity prices would still be a net positive for the global economy, especially where it reflects high supply at least as much as weak demand.

Bear markets (20% plus declines in the U.S. stock market) typically only occur around recessions since corporate earnings – and the price investors are willing to pay for them – tend to be low during economic downturns. Declines of 10% or so in the S&P 500 are much more common and just as fleeting. While we are not calling the bottom, we do think this is setting up for a decent buying opportunity for the future. U.S. corporate profit appears set to improve over coming quarters while recent pullback in equity prices has helped reduce the headwind of high valuation.

If you have any questions or would like to talk about the market and how it relates to your financial plan, please give us a call.