More Than Just a Number: Age and Retirement

Deciding what age to retire may not be one decision but a series of decisions and calculations. For example, you’ll need to estimate not only your anticipated expenses, but also what sources of retirement income you’ll have and how long you’ll need your retirement savings to last. You’ll need to take into account your life expectancy and health as well as when you want to start receiving Social Security or pension benefits, and when you’ll start to tap your retirement savings. Each of these factors may affect the others as part of an overall retirement income plan.

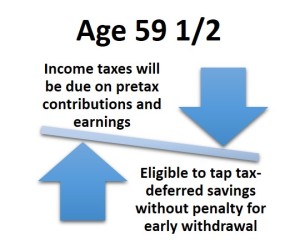

If you hope to retire before you turn 59½ and plan to start using your 401(k) or IRA savings right away, you’ll generally pay a 10% early withdrawal penalty plus any regular income tax due.The earlier you retire, the more years you’ll need your retirement savings to produce income. And your retirement could last quite a while.

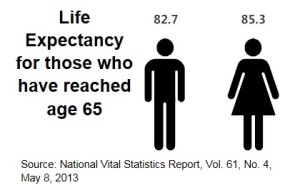

If you hope to retire before you turn 59½ and plan to start using your 401(k) or IRA savings right away, you’ll generally pay a 10% early withdrawal penalty plus any regular income tax due.The earlier you retire, the more years you’ll need your retirement savings to produce income. And your retirement could last quite a while.  According to a National Vital Statistics Report, people today can expect to live more than 30 years longer than they did a century ago. Not only will you need your retirement savings to last longer, but inflation will have more time to eat away at your purchasing power. If inflation is 3% a year–its historical average since 1914–it will cut the purchasing power of a fixed annual income in half in roughly 23 years.

According to a National Vital Statistics Report, people today can expect to live more than 30 years longer than they did a century ago. Not only will you need your retirement savings to last longer, but inflation will have more time to eat away at your purchasing power. If inflation is 3% a year–its historical average since 1914–it will cut the purchasing power of a fixed annual income in half in roughly 23 years.

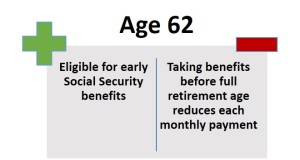

If you begin collecting retirement benefits at age 62, each monthly benefit check will be 25% to 30% less than it would be at full retirement age. The exact amount of the reduction will depend on the year you were born. However, even though your monthly benefit will be 25% to 30% less if you begin collecting retirement benefits at age 62, you might receive the same or more total lifetime Social Security benefits as you would have had you waited until full retirement age to start collecting benefits. That’s because even though you’ll receive less money per month, you might receive more benefit checks.

If you begin collecting retirement benefits at age 62, each monthly benefit check will be 25% to 30% less than it would be at full retirement age. The exact amount of the reduction will depend on the year you were born. However, even though your monthly benefit will be 25% to 30% less if you begin collecting retirement benefits at age 62, you might receive the same or more total lifetime Social Security benefits as you would have had you waited until full retirement age to start collecting benefits. That’s because even though you’ll receive less money per month, you might receive more benefit checks.

![]() At age 65 you become eligible for Medicare. Anyone who receives Social Security benefits before age 65 or who applies for Social Security benefits at age 65 will be automatically enrolled in Medicare. However, if you retire after age 65, remember to enroll in Medicare at age 65 anyway, because your enrollment won’t be automatic.

At age 65 you become eligible for Medicare. Anyone who receives Social Security benefits before age 65 or who applies for Social Security benefits at age 65 will be automatically enrolled in Medicare. However, if you retire after age 65, remember to enroll in Medicare at age 65 anyway, because your enrollment won’t be automatic.

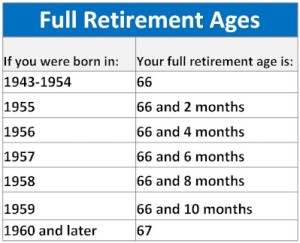

When you are 66-67 you will reach full retirement age for Social Security (depending on when you were born). Once you reach full retirement age, you can work and earn as much income as you want without reducing your Social Security retirement benefit. And keep in mind that if some of your benefits are withheld prior to your full retirement age, you’ll generally receive a higher monthly benefit at full retirement age, because after retirement age the SSA recalculates your benefit every year and gives you credit for those withheld earnings.

want without reducing your Social Security retirement benefit. And keep in mind that if some of your benefits are withheld prior to your full retirement age, you’ll generally receive a higher monthly benefit at full retirement age, because after retirement age the SSA recalculates your benefit every year and gives you credit for those withheld earnings.

Check your assumptions

The sooner you start to plan the timing of your retirement, the more time you’ll have to make adjustments that can help ensure those years are everything you hope for. If you’ve already made some tentative assumptions or choices, you may need to revisit them, especially if you’re considering taking retirement in stages. And as you move into retirement, you’ll want to monitor your retirement income plan to ensure that your initial assumptions are still valid, that new laws and regulations haven’t affected your situation, and that your savings and investments are performing as you need them to.