Leasing a Car – The Good and The Bad

Very few people actually enjoy walking onto the lot of a car dealership. For some, the haggling involved in the transaction can make the experience drag out for what feels like an eternity. Add to the mix, determining whether buying or leasing is the best alternative and you might break out into a cold sweat. We’re happy to offer advice for your specific financial situation just drop us a line. In the meantime, I thought it would be helpful to lay out some of the aspects of the leasing option.

For starters, when you lease a vehicle, you essentially rent the car for two to five years in exchange for your monthly payments. At the end of your lease term you return the car to the dealer, although you may have the option to buy the car. You negotiate the price of the car (in leasing terms, the capitalized cost) with a car dealer.

The Good

- Allows you to get a new car every few years

- Lower monthly payments

- Lower down payments required

- Eliminates the hassle of disposing of your old car

The Bad

- Lease contracts can be confusing and misleading

- Penalties are generally imposed for exceeding your mileage limit

- Costs associated with excess wear and tear to the vehicle

- Total costs may be relatively high if you decide to purchase the car at the end of the lease term

Your monthly lease payment is based on four variables:

- The capitalized cost or the actual price of the car you’re leasing

- The expected residual value or what the car will be worth at the end of the lease

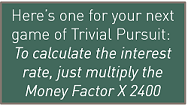

- The money factor, which is similar to the interest rate on a loan, and

- The loan term or the length of the lease

Your payments are designed to cover any depreciation in the vehicle + interest, taxes, and lessor profit. Depreciation is assumed to be the difference between the capitalized cost and the residual value. The wider the gap between these two figures, the larger your lease payment will be. Changes in any variable can have a dramatic effect on the amount of your payment. For example, if the capitalized cost is unusually high or the residual value extremely low, your payment amount will increase accordingly.

What to do at the end of the lease

At the end of the lease term, you have some options:

- Return the car and walk away – as long as you are within the allowed miles, and the car is in good condition, you’re all done!

- Buy the car at the purchase option price established at the beginning of the lease – if you have taken good care of the car, it may be worth more than the residual value, making it a bargain buy. Even if you don’t want to keep the car, you may be able to sell it at a profit. You may also consider this option if the car is in extremely poor condition in order to avoid the high lease-end charges.

- Extend the lease on a month-to-month basis – if you want to drive the car a little longer, many lease agreements allow you to keep the car as long as you continue to make monthly payments. Check your lease agreement or talk to your dealer about this option.

As you can see, there are quite a few factors that go into the process of leasing a vehicle and determining the price you will pay each month. Leasing has become a popular alternative to buying, and we have helped many of our clients with these types of transactions. If you’d like to discuss the topic more, just let us know!